What is Personal Finance Flowchart- A Complete Guide

Edraw Content Team

Do You Want to Learn More about Personal Finance Flowchart?

EdrawMax specializes in diagramming and visualizing. Learn from this article to know everything about the improtance of personal finance flowchart!

Managing personal finances is one of the most challenging tasks. Do you experience the same difficulties? This is where a personal finance flowchart comes into play. This flowchart does a respectable job of helping you visualize how you should prioritize your finances.

Furthermore, a personal flowchart can also assist you in tracking your payments and bills. Preparing this flowchart allows you to get your finances in order easily. So, do you want to learn how to draw it? If yes, then keep reading this article.

1. The Importance of Personal Finance Flowchart

Making and directing decisions about money is the process of personal financial management. This covers everything, from setting a budget and investing to buying insurance and saving for retirement.

There are three reasons why you should use a personal finance flowchart:

- Using flowcharts for personal finance allows you to manage your finances and keep track of your bills.

- You can make a budget and determine where you might be able to save money by starting with your income and tracking where your money goes.

- You can also ensure that you're on top of your finances by using personal finance flowcharts to track them.

2. Steps to Draw a Personal Finance Flowchart

Now, you know how useful personal finance flowchart is. So, it's time to learn how to draw a personal finance flowchart. Well, there are five steps to follow, which are mentioned below:

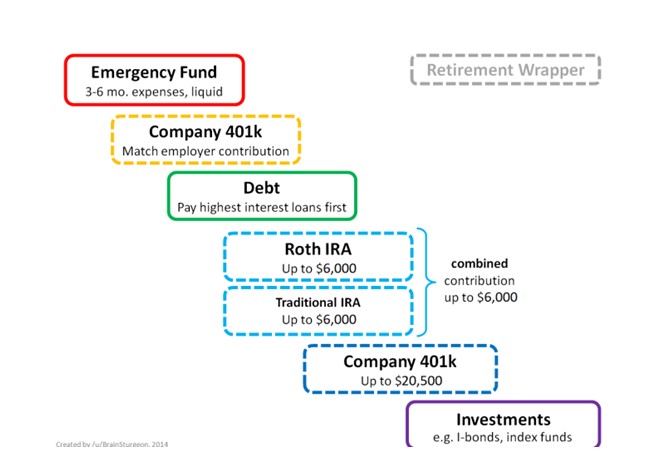

Step 1: Make your emergency fund

One of the first financial steps you should take is to start saving for emergencies. The emergency funds are set aside for unforeseen costs like medical bills or auto repairs. Many professionals advise keeping 3 to 6 months' living expenses in the emergency savings account. Putting an emergency fund in place can help you avoid going into debt when unplanned expenses arise.

Step 2: Use your employer's 401(K) match

Personal finance is an important but frequently disregarded aspect of life. Without a firm grasp of the personal finance flowchart, it is simple to accumulate debt or make unwise investment decisions. However, you can position yourself for success by learning about personal finance and creating a financial plan. Using the 401K match provided by your employer is one of the first steps in developing a personal financial plan.

Your retirement savings will increase right away if you make enough contributions to get the full match. This will not only enable you to retire, but it may also enable you to reduce your tax burden.

Step 3: Payoffs your debt

If you have emergency savings and are contributing to your retirement funds, you can focus on debt repayment. The most efficient strategy is to prioritize the debts with the highest returns. Then, when you pay off the high-interest debt, you will reduce your interest payments and have more money to apply to other debts.

If you have emergency savings and are contributing to your retirement funds, you can focus on debt repayment. The most efficient strategy is to prioritize the debts with the highest returns. Then, when you pay off the high-interest debt, you will reduce your interest payments and have more money to apply to other debts.

Step 4: Increase your IRA and 401K contributions (K)

Saving for retirement is an essential part of personal financial planning. There are numerous ways to save for retirement, but 401 k plans and Individual Retirement Accounts are two of the most common (IRAs). The tax advantages of 401(k) plans and IRAs can motivate you to increase your retirement savings.

Step 5: Continue to Invest

Throughout one's life, some financial decisions must be made. The goal of personal finance is to make these decisions in a way that leads to financial success. Therefore, investments are the most important aspect of financial management.

People can invest their money in assets that may increase in value over time. This could provide a substantial source of income during retirement and help to protect against inflation. These factors make it critical to continue investing even after you have met your financial goals. This will help you stay on track with your finances.

Here is an example:

3. Personal Finance Flowchart Examples

Now, let's see the >personal finance flowchart examples here.

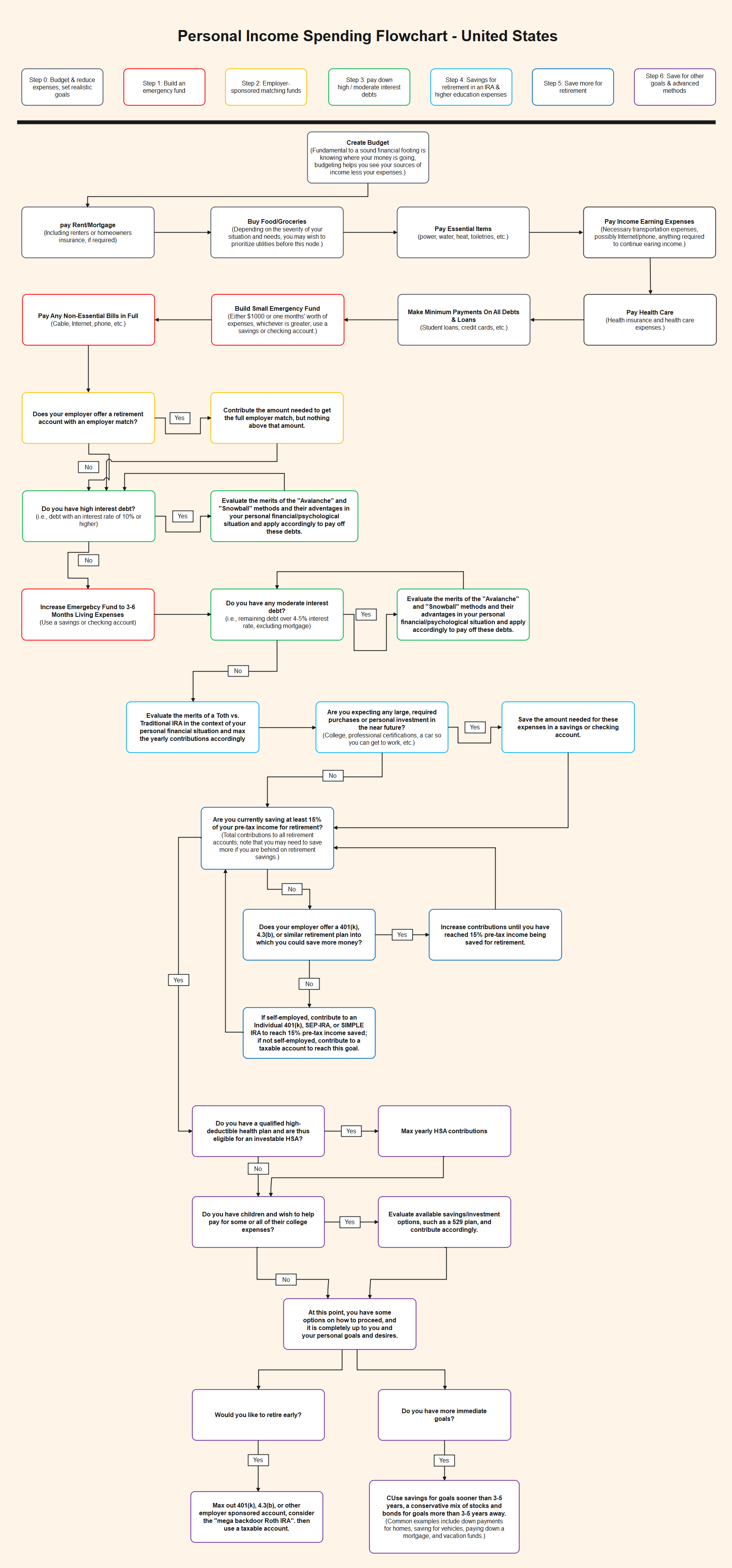

Personal Income Spending Flowchart

This personal income spending flowchart has multiple steps, which are mentioned below

- Step 0: Budget and reduce expenses.

- Step 1: Make an emergency fund.

- Step 2: Employer-sponsored matching funds.

- Step 3: Employer-sponsored matching funds.

- Step 4: Savings for retirement in an IRA and higher education expenses.

- Step 5: Save for retirement.

- Step 6: Save for other goals and advanced methods.

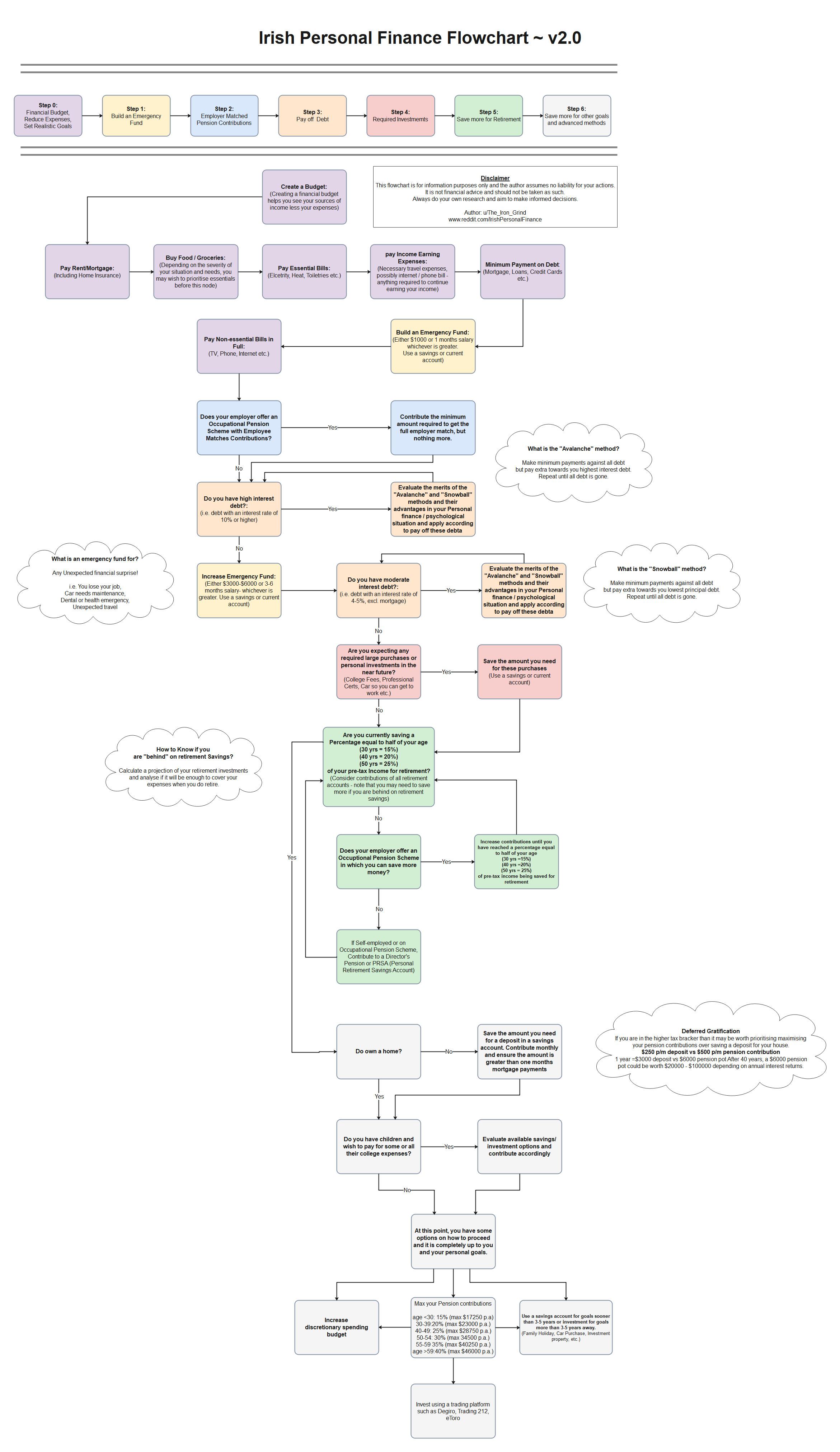

Irish Personal Finance Flowchart

Irish personal finance flowchart has several steps:

- Step 0: Financial Budget, reduce expenses and set realistic goals.

- Step 1: Create an emergency fund.

- Step 2: Employer-matched/pension contributions.

- Step 3: Debt repayment.

- Step 4: Required investments

- Step 5: Save for retirement.

- Step 6: Save more for other goals and advanced methods.

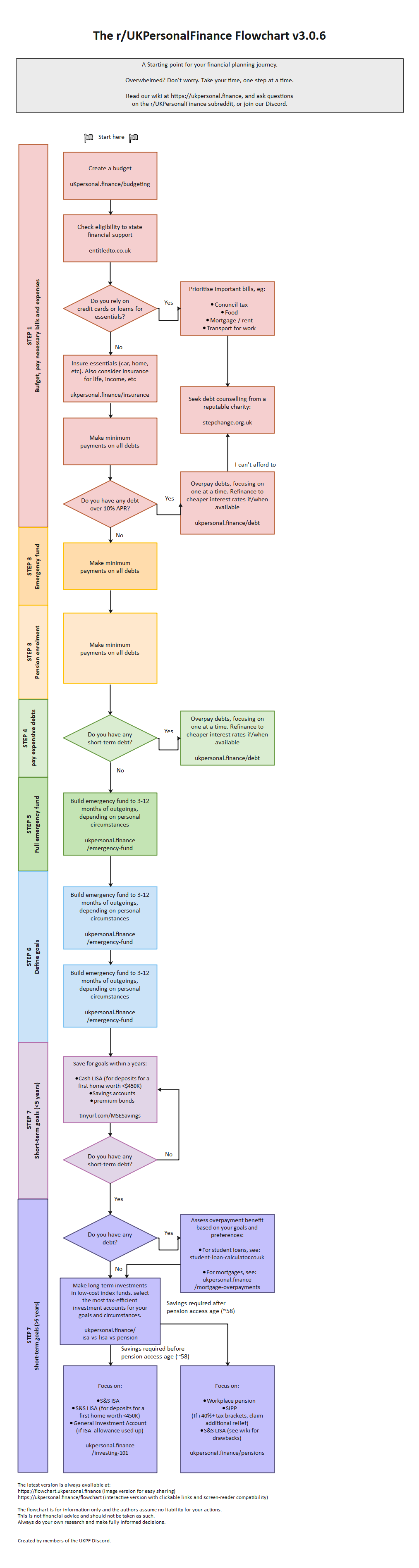

UK Personal Finance Flowchart

According to the UK personal finance flowchart, there are five major areas to consider. The five areas are saving, investing, financial protection, tax planning, and retirement planning.

These are the templates of the Reddit personal finance flowchart.

So, do you want to save your precious time? If your answer is yes, here is a bonus for you!

To save your precious time on creating your ideal personal finance, use EdrawMax Online right now. EdrawMax Online allows you to create the ideal form of diagrams that you would be unable to create manually with a pen and paper. The best part about this tool is that it is free software that provides easy-to-use innovative templates.

So, grab a template today or choose one from Templates Community and customize it to your liking.

4. Personal Finance Flowchart FAQs

Follow the recommended tips to make the most out of the workflow diagram.

4.1 What are the 3 M's of personal finance?

The 3 M's of personal finance is managing your money, multiplying your money, and maintaining your money.

4.2 What are the 5 main components of personal finance?

The 5 main components of personal finance are as follows:

- Savings

- Investment

- Financial security

- Tax planning

- Retirement planning

You should save money to cover any unexpected financial needs.

Investing is essential for growing money so that you can achieve your goals.

Financial security through insurance ensures that you and your family can get through difficult times.

With proper tax planning, you can reduce your taxable income and save significant money each year.

Retirement planning is essential to ensure that you have a large bank balance set aside solely for your needs in your golden years.

4.3 Can you hire someone to manage your personal finances?

Yes, you can hire a financial planner who can manage your personal finances and offer various financial planning services.

5. Personal Finance Flowchart FAQs

We hope you fully understand the personal finance flowchart now. So, don't miss an opportunity to use EdrawMax. With EdrawMax, you can make expert flowcharts and graphs for your personal finances that stand out in every way.

Flowchart Complete Guide

Check this complete guide to know everything about flowchart, like flowchart types, flowchart symbols, and how to make a flowchart.

You May Also Like

Cycle Diagram Complete Guide

Knowledge

Getting Things Done (GTD) Flowchart

Knowledge

How a Bill Becomes a Law Flowchart

Knowledge