What Is the Accounts Receivable Flowchart

Edraw Content Team

Do You Want to Make Your Accounts Receivable Flowchart?

EdrawMax specializes in diagramming and visualizing. Learn from this article to know about what is the accountes receivable flowchart, example of an accounts receivable process flowchart, and how to create an accounts receivable flowchart. Just try it free now!

Accounts receivables are the backbone of a company's financial flow. It's an accounting process that lets you track any purchases your customer made using credit. This is important to make sure you're collecting the money your customers owe you. For this reason, you need to optimize your accounts receivable workflow in the company.

By doing so, you're making it easier to collect payment efficiently and on time. Not only that, but it also helps you identify the accounts that are most likely to default. With that, you need an accounts receivable flowchart for a consistent and thorough collection process. Learn the basics of accounts receivable, how it works, and how to simplify the process by creating accounts receivable flowcharts.

1. What Is Accounts Receivable

Accounts receivables are the money a company should get after selling goods or providing services. It is the amount of money you have invoiced but have yet to receive payment. Managing accounts receivable effectively brings cash into the business before a bill is due or becomes a bad debt.

An organization provides this type of credit with short-term payment terms. It can be anything from a few days to a fiscal or calendar year.

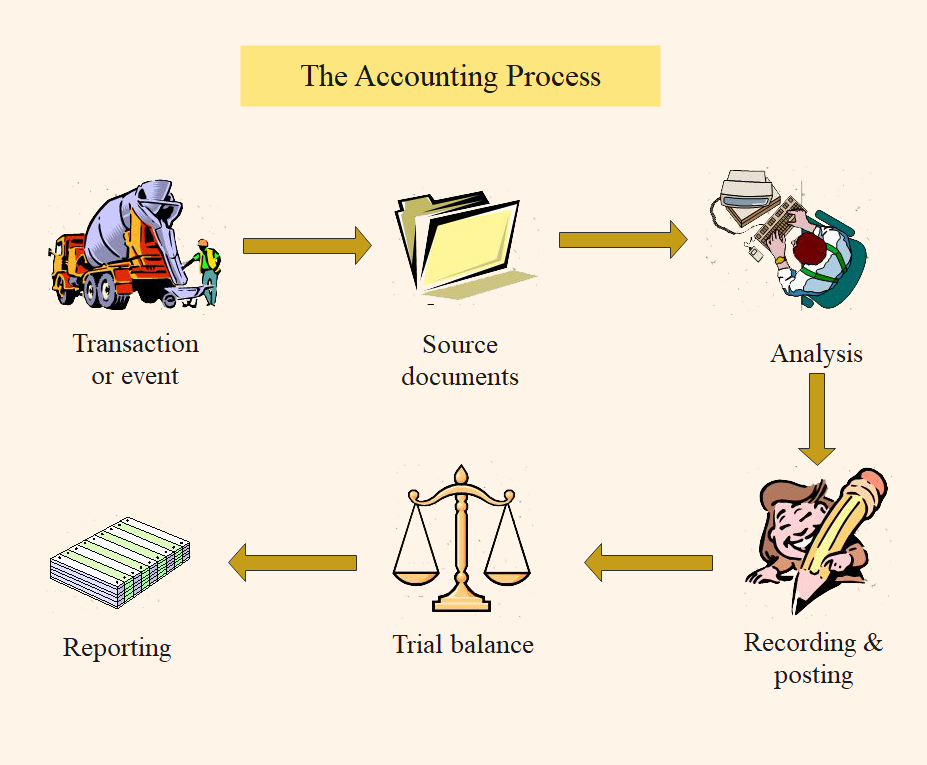

2. Understand the Basic Accounts Receivable Process

A company should set up an accounts receivable process to identify customers who have already paid and any past due payments. This immediately contributes to the company's liquidity and profitability. A competent accounts receivable procedure assists in determining customer creditworthiness and ensuring timely payments while preserving healthy customer relationships.

- Set up credit policies

- Issue invoices to customers

- Collect payments

- Reconcile accounts receivables

A typical accounts receivable process consists of the following steps:

Continue reading to learn more about each step in detail

Set Up Credit Policies

Identifying a customer's creditworthiness is the first step in the collection process. You must set clear credit conditions that outline the credit duration and interest rates in the event of a payment delay.

Create an intelligent credit policy that does not jeopardize corporate profitability to establish clear methods and workflows for evaluating debtors. The sales and accounts receivable departments can use this information to establish the invoicing and collection process.

Issue Invoices to Customers

Invoices are the primary sales evidence that serves as the contract's foundation. Customers who have requested credit for a sale should expect to receive an invoice shortly. The invoice should specify what the customer is paying for, credit terms, the mode of payment, and the deadline for paying. Each invoice must have a unique invoice number. This facilitates correct internal classification and tracking in the event of future complications.

Collect Payments

The collection of dues is the most important step in the accounts receivable process. Once the invoice reaches your clients, you must contact them proactively and develop a foolproof collection approach that can reduce the likelihood of involuntary churn by addressing payment issues.

To improve collection efficiency, closely monitor client involvement and implement customized workflows using the accounts receivable process flowchart. Depending on the credit duration, accounts receivable professionals must evaluate each account regularly.

Reconcile Accounts Receivables

In this step, you must record the accounts receivable in your books to complete the accounts receivable business operations. This involves documenting invoice payments. Hold accurate records of all incoming payments. You should also update your balance sheet, adjust for any bad debts, and account for overdue invoices throughout this stage of the process.

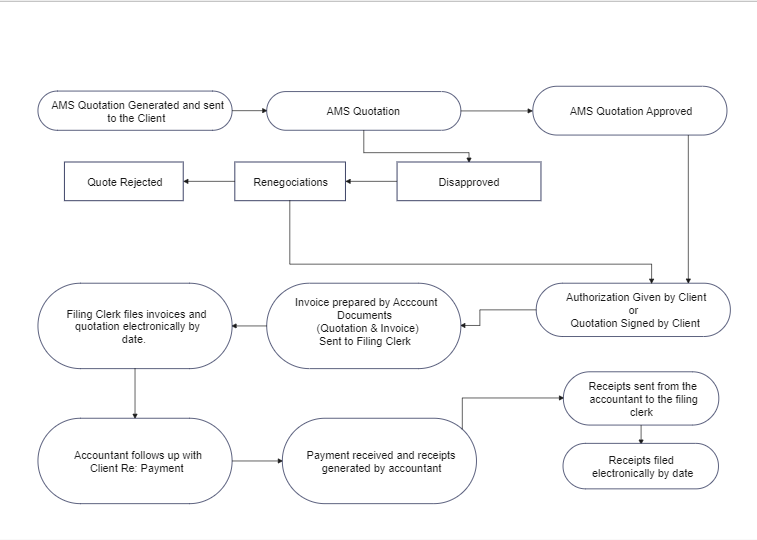

3. Example of an Accounts Receivable Process Flowchart

The accounting department requests a flowchart when they're having trouble finding the organization's requirements. One of these is the accounts receivable process flowchart. The accounts receivable process flowchart below shows the basic steps involved. It is a visual representation of the steps in the account receivables cycle. Check it out to see where each step happens in the right order.

Professional-looking flowcharts help an organization draw attention and communicate accounting procedures altogether. It intends to help all parties understand the tasks, data needed, point person, and how much time they should expect to spend.

4. How to Create an Accounts Receivable Flowchart

Do you ever get stuck creating your accounts receivable flowchart in different software? The key to an effective accounts receivable flowchart is knowing where to look for each and which will help you speed up your process of creating great charts that are easy to understand. Fortunately, there are different templates available on EdrawMax, so you can choose the one that most closely matches your needs.

EdrawMax is one of the best flowcharting tools out there. It has a vast number of templates available for all kinds of businesses and different purposes. It streamlines user operations and enhances drawing intelligence. With that, it provides users with an in-depth examination of multiple office drawing tools.

With their accounts receivable flowchart, you can map your accounts receivable and manage the entire process easier. It has strong compatibility support, which means you can import and export elements to different file formats, including PDF, Visio, Microsoft Office, and more. Let us visualize the process by creating an accounts receivable flowchart.

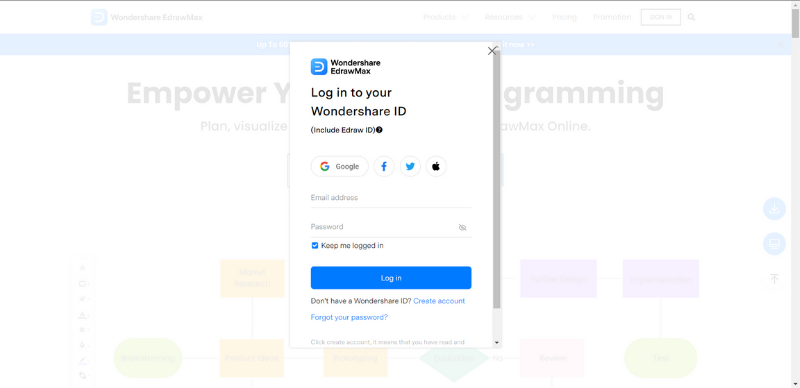

Step1 Go to EdrawMax Online or Download the EdrawMax Software

If you have never used EdrawMax, you can create a free account by entering your email address. You can then use EdrawMax for free.

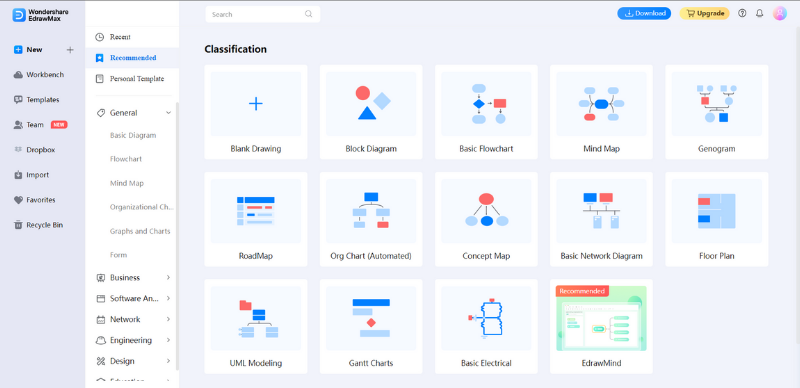

Step2 Choose Between a Blank Drawing and a Flowchart Template

When you're in EdrawMax, you can start with a blank drawing page and create a new flowchart from the ground up. Choose a Basic Flowchart template or build a new one by clicking "+" above Blank Drawing. If you want to save time creating an accounts receivable flowchart, you can open a pre-made flowchart template from our template library and then customize it. Click Templates in the left-side navigation pane.

Step3 Modify the Elements

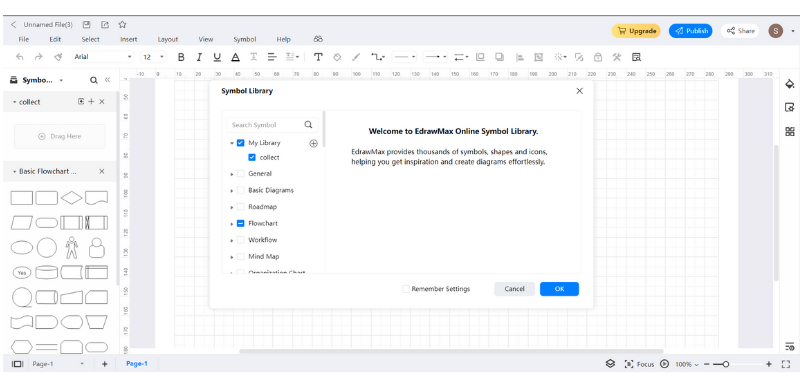

On the upper left side of the editor window, click Symbol Library. A dialogue box will then appear. Select Flowchart from the Symbol Library dialog box and click OK. Alternatively, you can import data from your device, and it'll generate an accounts receivable flow chart for you.

Step4 Customize the Accounts Receivable Flowchart

If you choose a pre-made template, you can add your preferred elements and remove those you do not want. You can choose from a wide selection of elements, clipart, and components in EdrawMax. Furthermore, it allows you complete control over every aspect of the template.

- Add Contents:

- Format Shape:

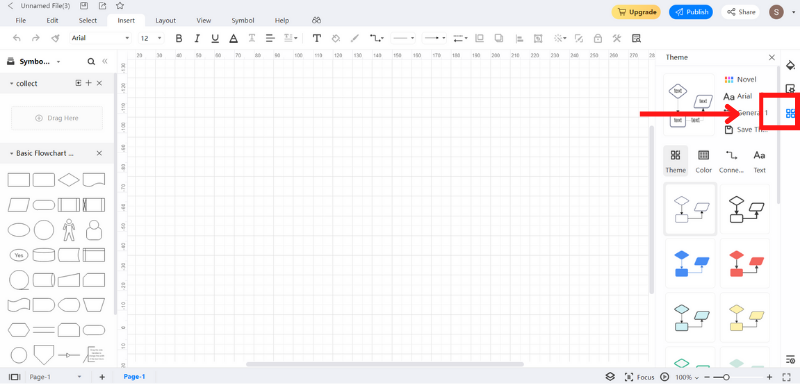

- Change Theme:

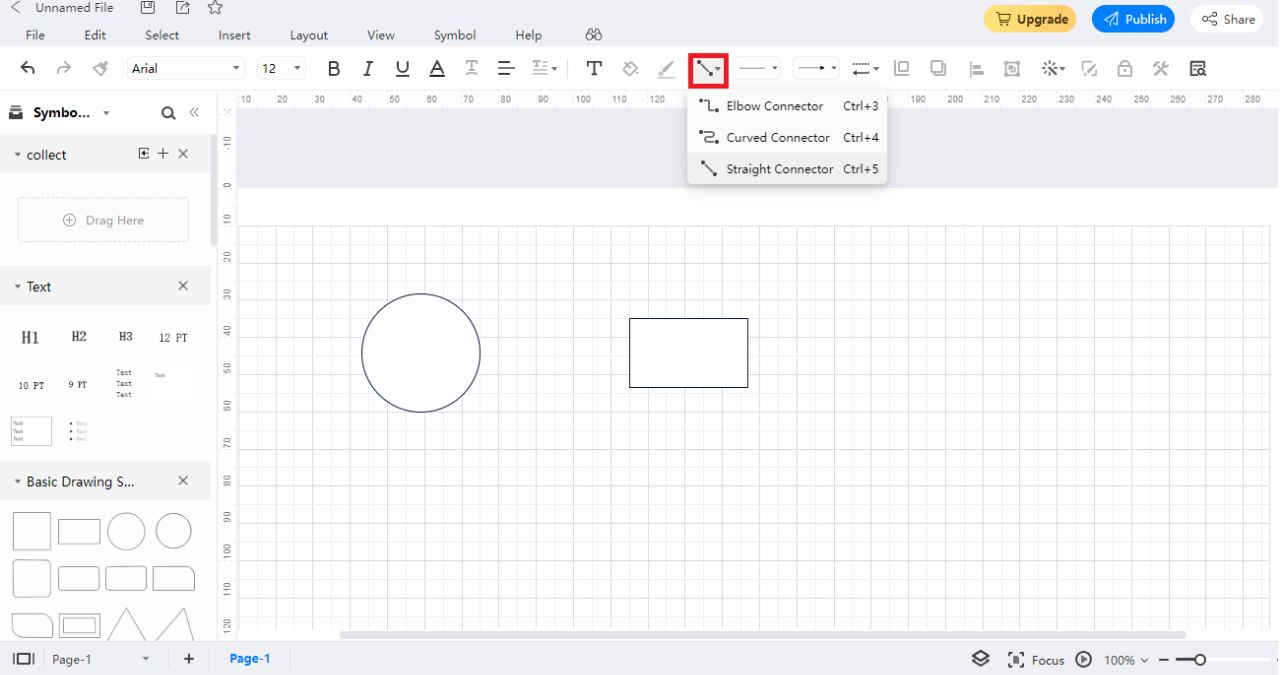

Once you have shapes on the drawing board, click Connector on the top navigation pane, as shown in the picture below. There will be options as to what kind of connector you want to use for the flowchart.

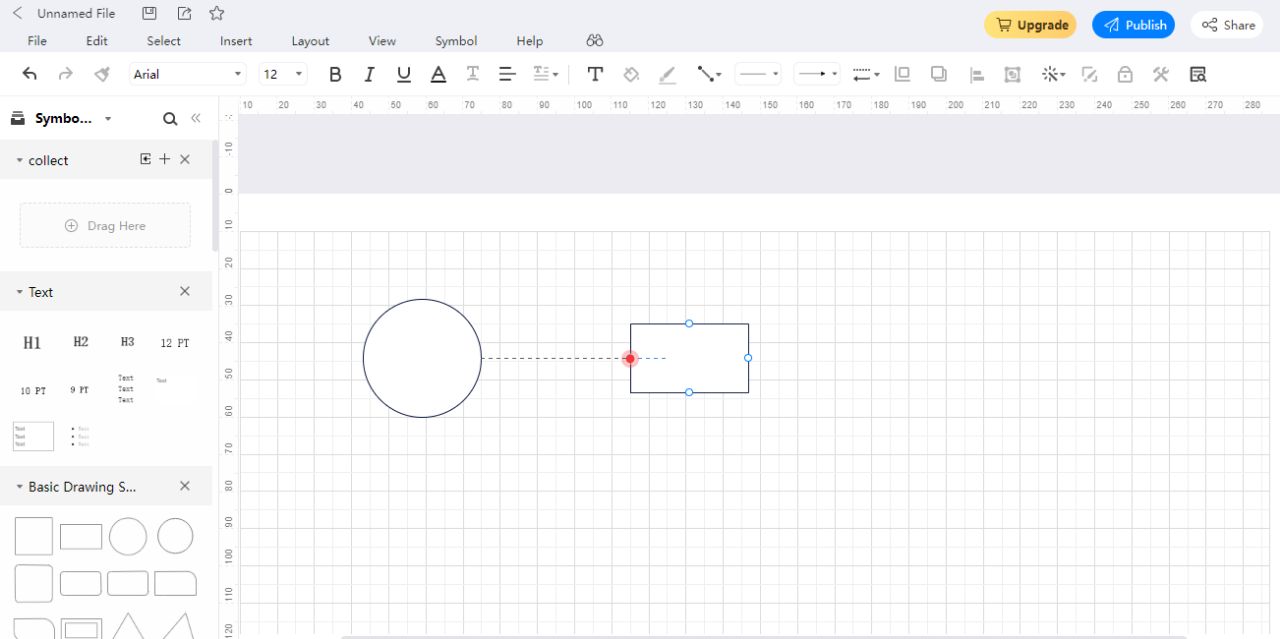

After clicking an option, hover the mouse on the first shape until you see a red dot, then drag and drop it onto the other shape.

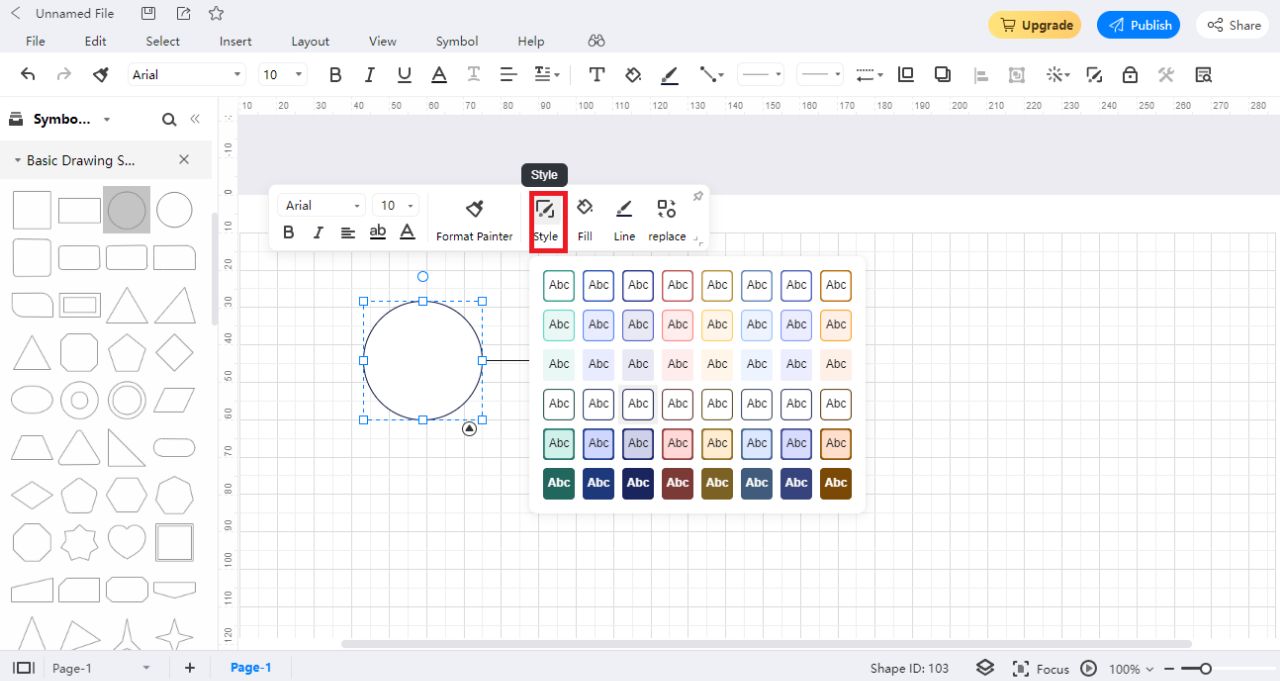

For certain shapes, click Style to open the Fill/Line/Shadow pane, so you can customize it as you like.

Click Theme in the right-side navigation pane. With a single click, you can now alter the theme scheme, theme color, connector style, and font type of your flowchart. Furthermore, EdrawMax's function allows you to view the immediate effect of changes on the drawing page. Therefore, you don't have to conduct too many extra switches for your flowchart.

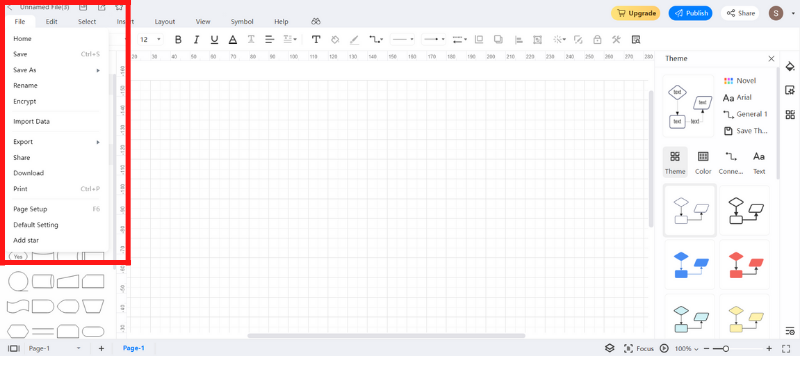

Step5 Export and Share the Accounts Receivable Process Flowchart

When you've finished creating your flowchart with EdrawMax, you can save and export it in different file formats. It includes graphics, SVG, PDF, HTML, Word, Excel, and PPT. In the upper left navigation pane, click File. Now, save or import the file in the format of your choice. You can also click Publish in the top right to share it on EdrawMax's social network.

5. Frequently Asked Questions

- What are the timelines for accounts receivable?

- What are the three major types of receivables?

- How can I improve my accounts receivable collection?

There is no schedule for repaying accounts receivable. As current assets, however, the customer should be able to settle the account balance within 12 months. Accounts receivables are typically due in 30 to 60 days and are deemed overdue after 90 days. The timing can vary depending on your industry.

Generally, receivables fall into trade accounts receivables, notes receivables, and other receivables. Trade accounts receivable refers to money owed to a company after selling goods or services on credit to a customer. Note receivables use a promissory note to extend the payment period between you and your counterparty (the debtor). Interest receivables, salary receivables, employee advances, and tax refunds are all examples of other receivables.

Combine automation and customization. Try to look for bottlenecks in your workflow with the accounts receivable process flowchart to increase efficiency throughout your firm. Use cash management solutions that will help you better manage accounts receivables. In case of missed payments, you should have a system in place that lets you act right away.

6. Conclusion

Unlike accounts payable, accounts receivable focuses on bringing cash in rather than disbursing it. A consistent administration and strong policies ensure smooth funds receivable cycles, timely payment of overdue invoices, and long-term business relations.

Accounts receivable process flowcharts made with EdrawMax help you define and improve your AR process. Once you can see how your process flows, it's easy to improve where needed, even if it's just rearranging steps to make them more efficient or effective. Not only does this reduce the entire lifetime, but it also results in fewer inefficiencies, more accurate reporting, and improved staff retention.

Process Flowchart Complete Guide

Check this complete guide to know everything about process flowchart, like importance of process flowchart, and how to draw process flowchart.

You May Also Like

Accounting Flowchart Complete Guide

Knowledge

Personal SWOT Analysis Complete Guide

Knowledge

Human Anatomy Complete Guide

Knowledge

Digestive System Diagram Complete Guide

Knowledge

Programming Flowchart Complete Guide

Knowledge